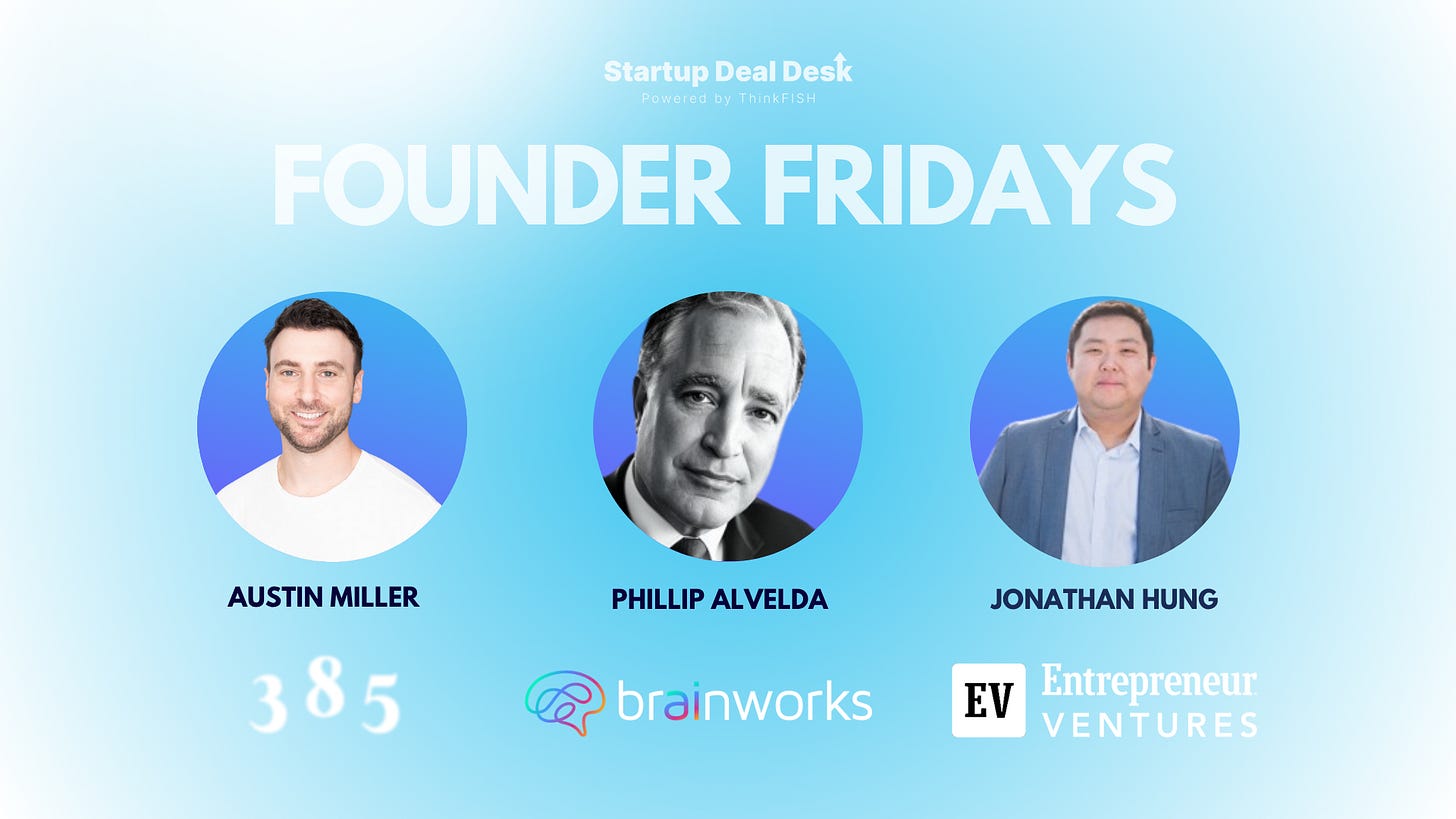

Signal, Not Noise: Three Allocators With Built-In Edge 🦈

This week’s #FF introduces the managers pairing capital with the kind of leverage startups can’t buy

The first week of Q4 is here. Markets are loud with government shutdown noise, AI headlines and endless crypto or IPO chatter.

But real breakthroughs don’t happen in the noise. They happen where categories blur - culture meets capital, tech meets tradition, founders meet opportunity.

This week’s ThinkFISH operators are building at those crossroads, turning intersections into platforms that can’t be ignored.

If you haven’t subscribed, please do.

🎣 This Week’s TL;DR

Austin Miller (385 Capital) → Partner with 13+ years across PE, VC, credit & real estate, backing cultural + frontier-tech plays like Pawn Shop and StealthCo.

Phillip Alvelda & Volkner Hirsch (Brainworks Ventures) → Decades together from DARPA neurotech to frontier-tech exits, now running an AI-native venture model.

Jonathan Hung (Entrepreneur Ventures) → 125+ startup investments, LP in 30+ funds, pairing capital with Entrepreneur Media’s 40M+ reach.

Austin Miller of 385 Advisory

Austin Miller is a Partner at 385 Capital, bringing more than 13 years of multi-stage, multi-industry experience across private equity, venture capital, private credit, and real estate.

Before joining 385, he served as Head of Investments at Saltwater, the family office of Uber’s first CEO. He also worked in M&A at IAC (Barry Diller’s holding company), in venture at Khazanah ($35B sovereign wealth fund), and in advisory at KPMG.

That cross-asset background gave him a vantage point few investors get: how capital moves between asset classes, and why family offices invest differently than institutions.

Why Investors Are Paying Attention:

Pawn Shop (Sports x Hospitality, Los Angeles): An elevated clubhouse concept backed by Mark Cuban, Bill Simmons, Dodgers’ Andrew Friedman, the Lasry family, Mookie Betts, Chandler Parsons, and a James Beard–winning chef.

StealthCo (AI x Fintech, Pre-Seed): Reportedly piloting with 30+ institutions managing $100B+ AUM, with early technical backers including Yann LeCun (Meta Chief AI Scientist) and senior researchers from OpenAI, DeepMind, and Anthropic.

Deck or One-Pager Only Available by Request

🔗 Austin Miller on LinkedIn | Company LinkedIn | Schedule an Intro Call

Phillip Alvelda and Volkner Hirsch of Brainworks Ventures

At Brainworks Ventures, Phillip and Volker aren’t just backing AI, they’re using it to run their own shop. From sourcing to diligence to portfolio construction, they’ve built an “AI-native” model designed to move faster and leaner than traditional VC. Company LinkedIn

Their partnership spans decades and industries, DARPA-backed neurotech, multiple high-value exits, and operational roles scaling frontier technologies. Now, they’re applying that depth to early-stage AI companies that can do more with less.

Why LPs Take Notice:

AI-optimized fund operations.

Decades of building and exiting frontier-tech ventures.

Track record of working together through multiple cycles.

🔗 Synopsis | Pitch Deck | Phillip Alvelda on LinkedIn | Schedule an Intro with Phillip | Volkner Hirsch on LinkedIn | Schedule an Intro with Volkner

Jonathan Hung of Entrepreneur Ventures

Jonathan Hung is a connector by nature, fusing capital with media distribution to give founders not just funding, but a spotlight that accelerates credibility and adoption.

With 125+ startup investments and 30+ fund LP roles, Jonathan has lived every side of venture. Now, through Entrepreneur Ventures, he pairs that experience with the unmatched reach of Entrepreneur Media (40M+ across digital, print, podcasts, and events). The result: founders get instant visibility, trust, and traction that money alone can’t buy.

For LPs, Jonathan is the bridge to vetted early access with built-in amplification. For founders, it’s capital plus a megaphone - a unique model where credibility and growth are part of the investment. Company LinkedIn

📊 125+ startup investments, 30+ fund LP roles proven operator and investor.

🚀 Warehoused companies already showing markups before Fund I launch.

🎤 Media platform with 40M+ reach that accelerates portfolio visibility

🔗 Executive Summary | One-Pager | Jonathan Hung on LinkedIn | Schedule an Intro with Jonathan

🦈 ThinkFISH EDGE

Capital alone is a commodity. Edge is the differentiator.

The managers shaping tomorrow aren’t following the same playbook - they’re embedding signal into every check: distribution that moves markets, AI-native clarity, and cultural gravity that compounds beyond capital.

As you head into the weekend and Q4, ask yourself: 👉 Are you following the crowd… or backing the allocators tilting the table?

📍 Want this kind of traction?

We help founders and fund managers get in front of 80,000+ angels, VCs, family offices, and tech leaders. → Schedule a 1:1 Discovery Call

Disclosure: Founder Friday is for informational purposes only and not an offer to sell or solicit securities. Investments are made only via official materials and require investor qualification.

📱 Follow us on LinkedIn and X for more founder-led deals and sharp capital signals.